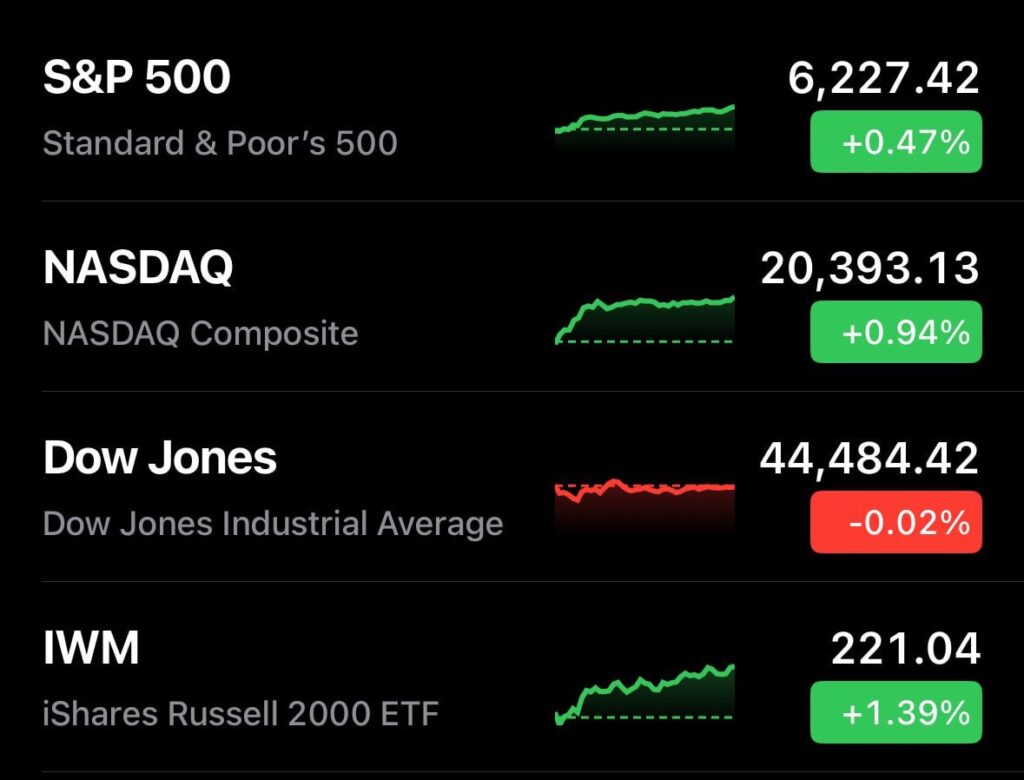

The S&P 500 closed at 6,227.42, marking its sixth record high of 2025. The rally was driven by robust gains in major technology stocks, with Apple, Nvidia and Tesla at the forefront.

What is pushing stocks higher

Tech giants led the latest leg up. Apple rose more than 2 percent, Nvidia gained over 2.5 percent and Tesla jumped close to 5 percent. The broader Nasdaq also climbed nearly 1 percent, closing at a fresh high, while the Dow Jones dipped slightly.

Improved trade sentiment, following new agreements with Vietnam, and easing inflation pressures added to the optimism. Investors are increasingly confident that the Federal Reserve may hold off on additional rate hikes as price growth cools.

Signs of strong technical momentum

The index recently flashed a golden cross, a pattern where the 50-day moving average moves above the 200-day line. Historically, this signal has often preceded further gains over the following year.

Market strategists note that such setups tend to draw more buyers, reinforcing the uptrend. However, they caution that with valuations stretched, the market remains sensitive to surprises.

Risks still linger

Despite the upbeat tone, some analysts warn that high valuations, slowing consumer spending and geopolitical tensions could limit how far the rally goes. The forward price-to-earnings ratio is above 22, and measures like the Buffett Indicator show markets near historical extremes.

Much now depends on upcoming economic data, including labor market updates and any new signals from the Fed. Strong corporate earnings will also be critical to justify current prices.

What to watch next

The S&P 500 continues to benefit from powerful trends in technology and improving macro data. Whether it can sustain this record pace will hinge on the balance between solid fundamentals and caution over high valuations.