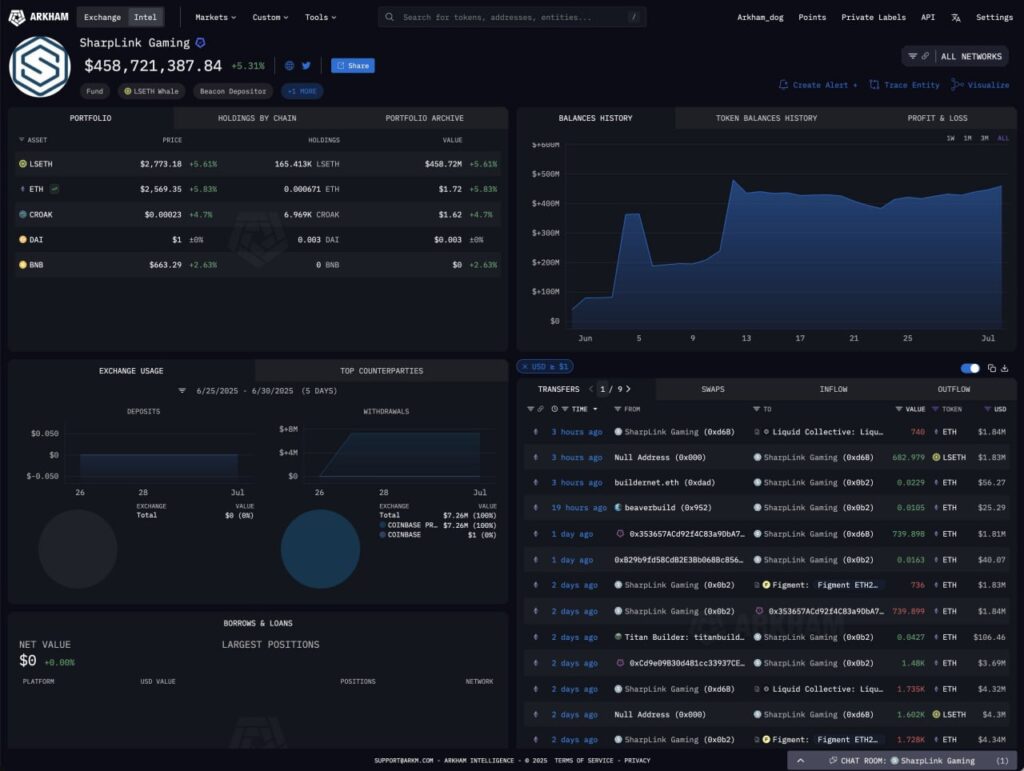

SharpLink Gaming, a Nasdaq-listed sports betting company, has quickly become one of the largest corporate holders of Ethereum worldwide. Its recent buying spree has pushed its treasury above 200,000 ETH, valued at roughly 500 million dollars.

Aggressive accumulation this month

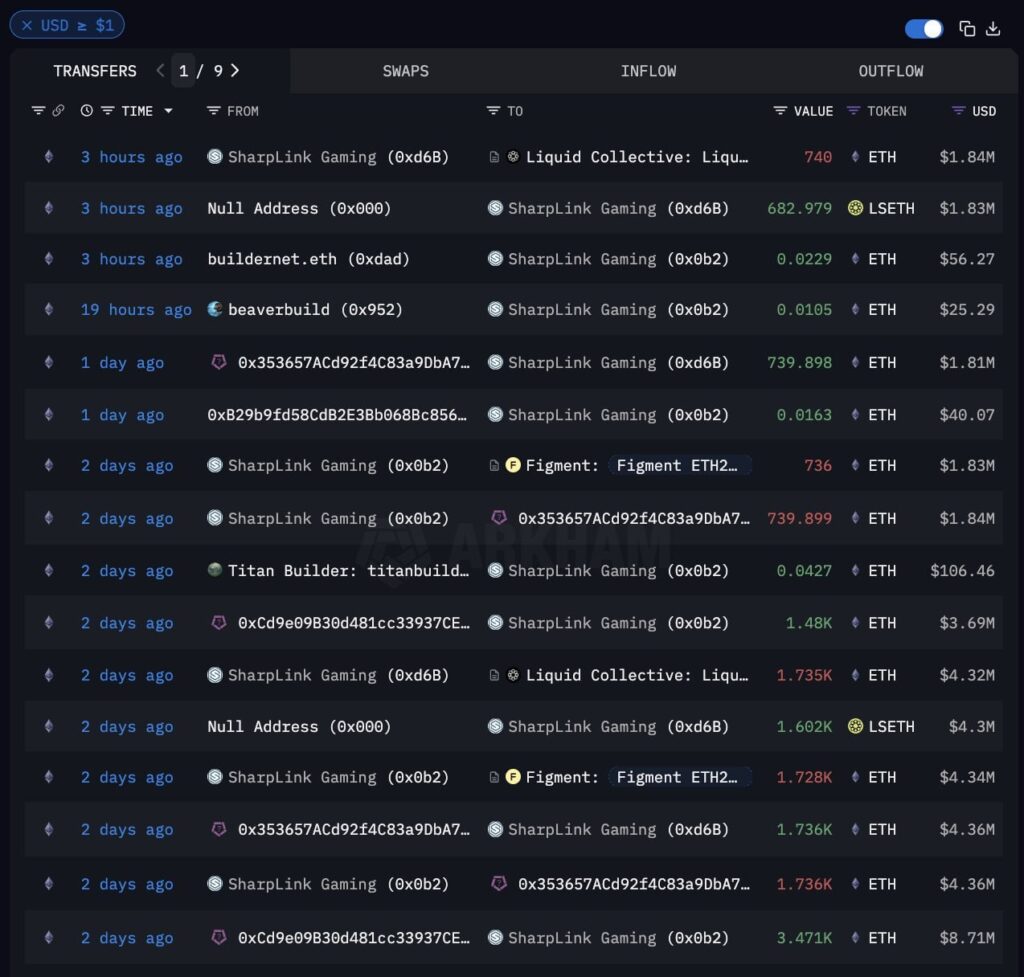

In mid-June, SharpLink acquired about 176,000 ETH for approximately 463 million dollars, making it second only to the Ethereum Foundation and a handful of ETFs. Between June 16 and 20, the company added another 12,000 ETH worth just over 30 million dollars. By the end of the month, it purchased nearly 5,000 more ETH, taking the total beyond 200,000 ETH.

Most of the ETH is staked

SharpLink confirmed that more than 95 percent of its Ethereum holdings are deployed in staking protocols like Liquid Collective and Figment. This strategy is already generating returns. In June alone, the company earned around 120 ETH in rewards, climbing to over 220 ETH by the end of the month.

How the acquisitions were funded

To support these large purchases, the company combined a 425 million dollar private placement led by ConsenSys with an at-the-market equity program that raised another 79 million dollars just in June.

Sharp price swings in the stock

Shares of SharpLink soared over 400 percent after the initial ETH buying announcement but later dropped about 70 percent in mid-June due to confusion around SEC filings. Chairman Joseph Lubin, also co-founder of Ethereum, clarified that there was no insider selling and that the company’s core holdings remain intact.

Following a MicroStrategy-like path

SharpLink is using Ethereum as its primary treasury reserve asset, closely mirroring the strategy MicroStrategy employed with Bitcoin. This places the company at the forefront of institutional ETH adoption and signals a broader shift in corporate interest toward digital assets beyond BTC.