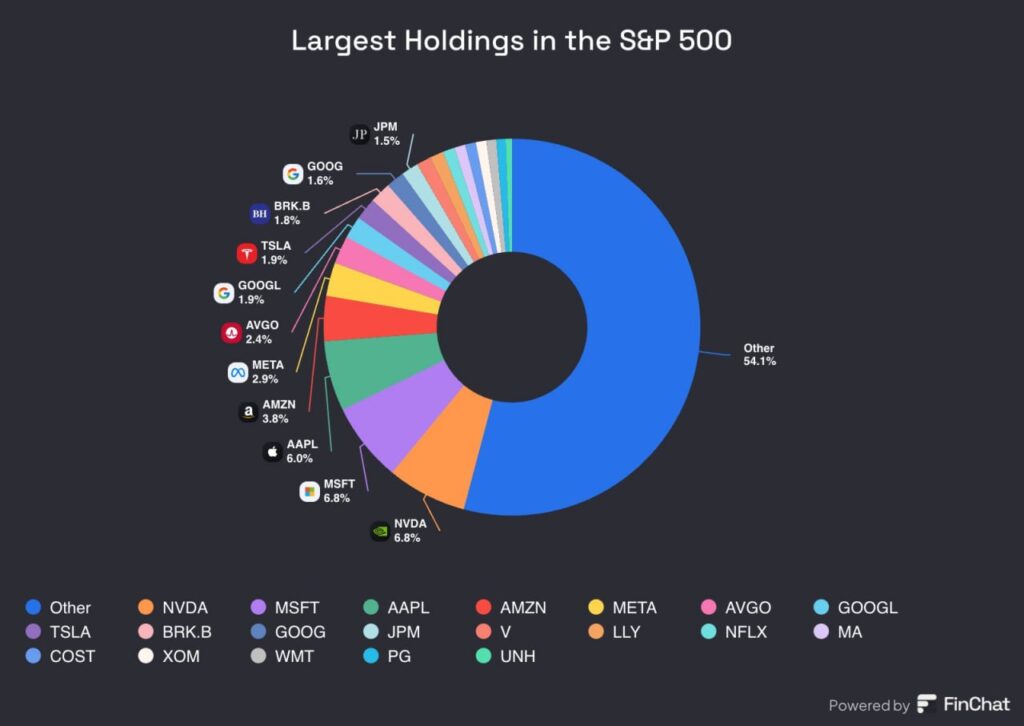

A closer look at where the big money is concentrated

Two of the most popular indexes in the world, the NASDAQ 100 and the S&P 500, may seem similar at first glance. But when you break down their largest holdings, the contrast is clear and it matters for investors who want to understand where the capital is flowing.

🔍 Tech-heavy or diversified?

Let’s start with the NASDAQ 100. The index is dominated by tech giants

The top 7 tech companies alone make up more than 40% of the NASDAQ 100. By contrast, the S&P 500 spreads its weight more evenly across sectors, with these same companies representing a smaller portion of the index.

🧠 What’s in the “Other” category?

This is a key distinction. The S&P 500 covers a broader slice of the American economy. It includes banks like JPMorgan, energy giants like ExxonMobil, and healthcare leaders like UnitedHealth companies you won’t find in the NASDAQ 100.

⚖️ Strategy matters

- The NASDAQ 100 is built for growth-focused investors. It’s concentrated, volatile, and tech-centric.

- The S&P 500 is more balanced, representing all major sectors. It’s a better barometer of the overall US economy.

Final thought

Understanding what’s under the hood of each index helps investors align their strategy. If you’re betting on the future of AI, cloud, and digital infrastructure, the NASDAQ 100 gives you exposure. If you’re looking for diversification and long-term economic resilience, the S&P 500 has your back.

Want a more dynamic portfolio? Some smart investors are now blending tokenized assets, crypto yield strategies, and traditional index exposure.