Published 22 May 2025 – XSTPNews

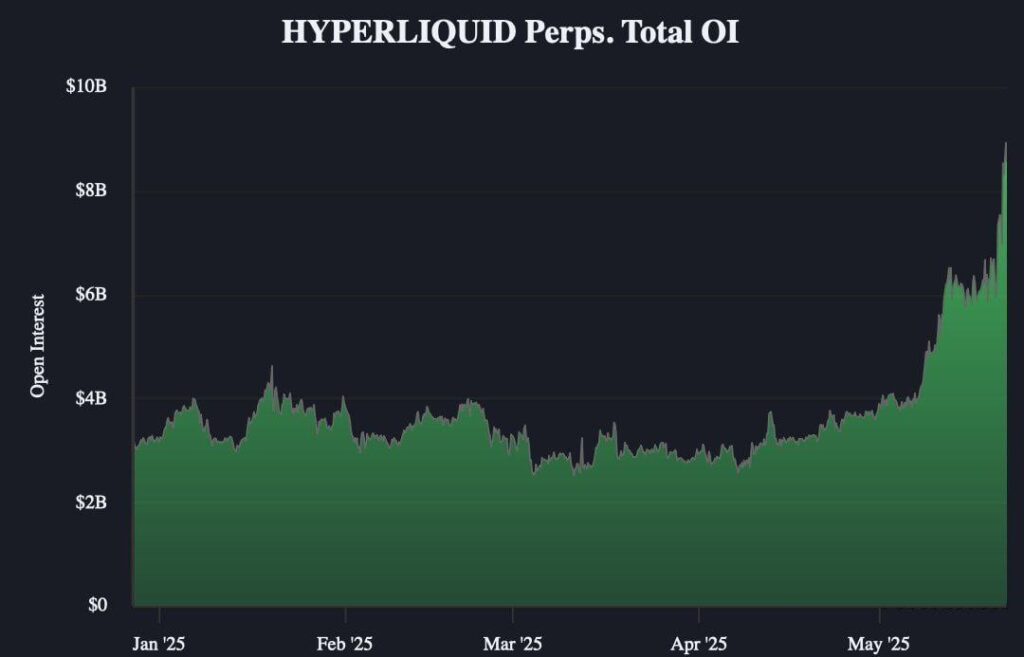

Hyperliquid just made a move that’s impossible to overlook. The platform has reached an impressive $8.92 billion in open interest and $18.91 billion in 24-hour trading volume, securing a spot among the top five global crypto derivatives exchanges, right behind Binance, Bitget, Bybit, and OKX.

This wasn’t random. Momentum has been building for months. Traders are choosing Hyperliquid not because of hype or influencers but because it consistently delivers what truly matters: speed, stability, deep liquidity, and clean execution.

What makes this rise stand out is how it happened. No aggressive marketing. No celebrity push. Just a platform that works. Professionals notice. When you’re trading serious volume, every tick and every millisecond count. Hyperliquid understands that, and the market is responding.

But this isn’t just about rankings. It reflects a deeper shift. The industry is evolving, and institutional capital is paying attention. Efficiency now outweighs reputation. Legacy platforms no longer hold all the cards.

For anyone paying attention, the message is clear. This market rewards performance, not promises.