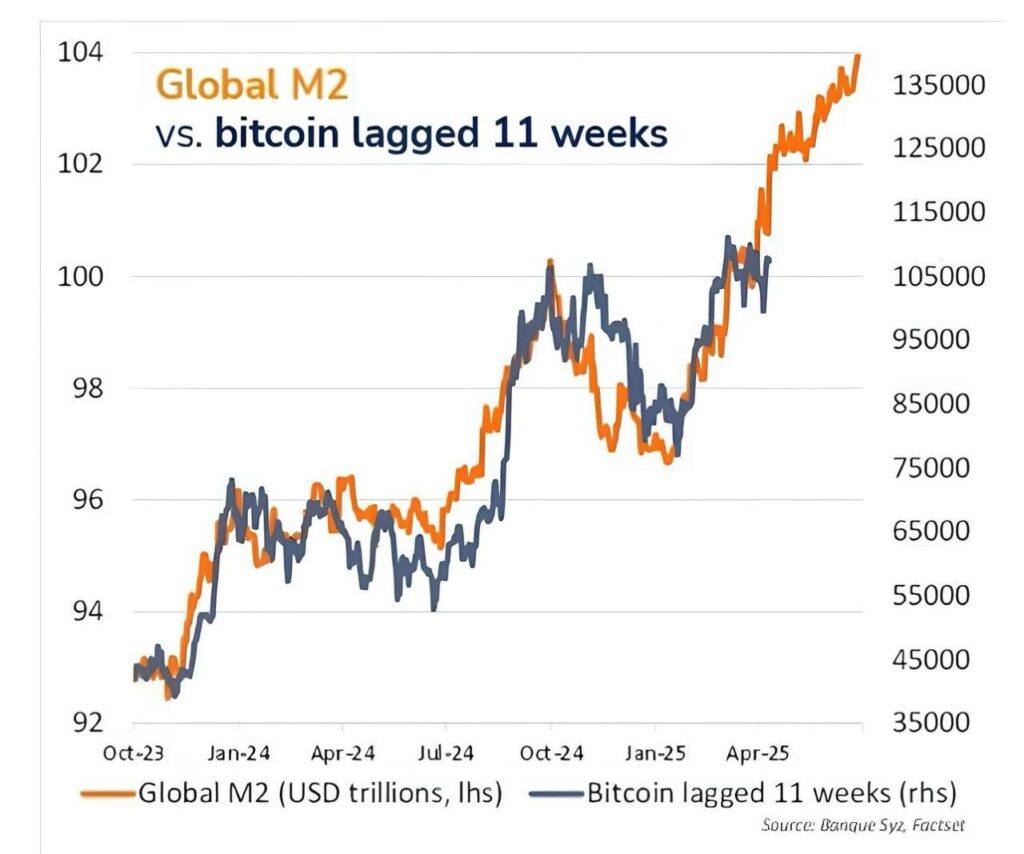

Bitcoin may be on the verge of another powerful rally. Data from Banque Syz and FactSet shows that global M2 money supply a broad gauge of worldwide liquidity often leads Bitcoin’s price by about 11 weeks. With M2 pushing to record highs, this could signal BTC moving toward $135,000 in the coming months.

Liquidity expands before Bitcoin reacts

Recent figures indicate global M2 has surged over 3.8% year-over-year, topping $55 trillion. Historically, such jumps in liquidity have preceded large moves in Bitcoin, which tends to lag by roughly 10 to 12 weeks.

This correlation played out again recently. As M2 hit new peaks, Bitcoin followed about three months later, briefly climbing above $104,000. Some on-chain analyses suggest this lag is a persistent pattern tied to how excess liquidity eventually flows into risk assets.

Is it real predictive power or just noise?

Skeptics warn the link might be misleading. Critics point out that global M2 is stitched together from uneven country data, sometimes revised months later. Quantitative analysts also argue that choosing an 11-week lag could be an example of shaping data to fit narratives.

Still, even cautious investors watch liquidity growth closely. Rising M2 often boosts markets across the board, making it a macro force that’s hard to ignore.

A pivotal few months ahead

If the historical lag continues, Bitcoin may respond to the latest surge in M2 by climbing toward $135,000 later this year. However, correlation does not guarantee causation. Traders will be watching closely to see if fresh liquidity again finds its way into BTC.