Bitcoin ETFs in the US continue to pull in heavy capital, showing strong institutional demand even amid global market uncertainty. On July 2, 2025, Fidelity’s ETF (FBTC) saw about 1,680 BTC flow in, worth roughly $184 million in just one day.

Big players move millions into Fidelity’s ETF

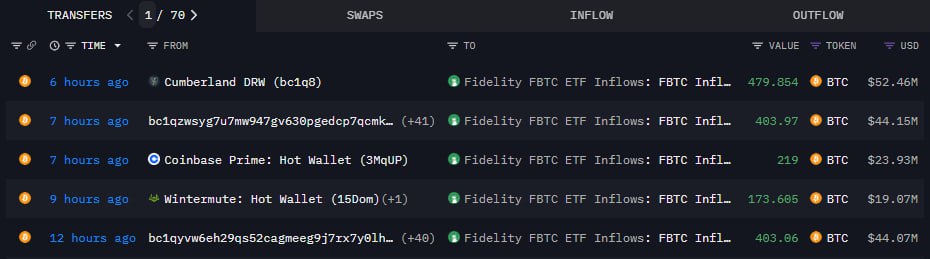

On-chain data highlighted major transactions going directly to Fidelity’s ETF custody:

- Cumberland DRW sent 479.85 BTC (~$52.4M)

- Coinbase Prime moved 219 BTC (~$23.9M)

- Wintermute added 173.6 BTC (~$19M)

- Other wallets chipped in hundreds more BTC

This underscores ongoing appetite from hedge funds, OTC desks and crypto-native institutions seeking regulated vehicles.

Bitcoin holds near $109 thousand

These ETF allocations came as Bitcoin traded around $109,800, showing resilience even with global volatility. Analysts point to ETF demand systematically pulling coins off spot markets, tightening available supply.

Market watches effects of this squeeze

In Q2, ETFs collectively saw inflows above $400 million daily across Fidelity, BlackRock and Ark. Meanwhile, Ethereum ETF flows lagged, reinforcing Bitcoin’s position as the top institutional asset.

Investors are watching closely. If ETF buying keeps up, it could drive Bitcoin out of its current range and set the stage for the next 2025 rally.