Published on May 21, 2025 by XSTPNews

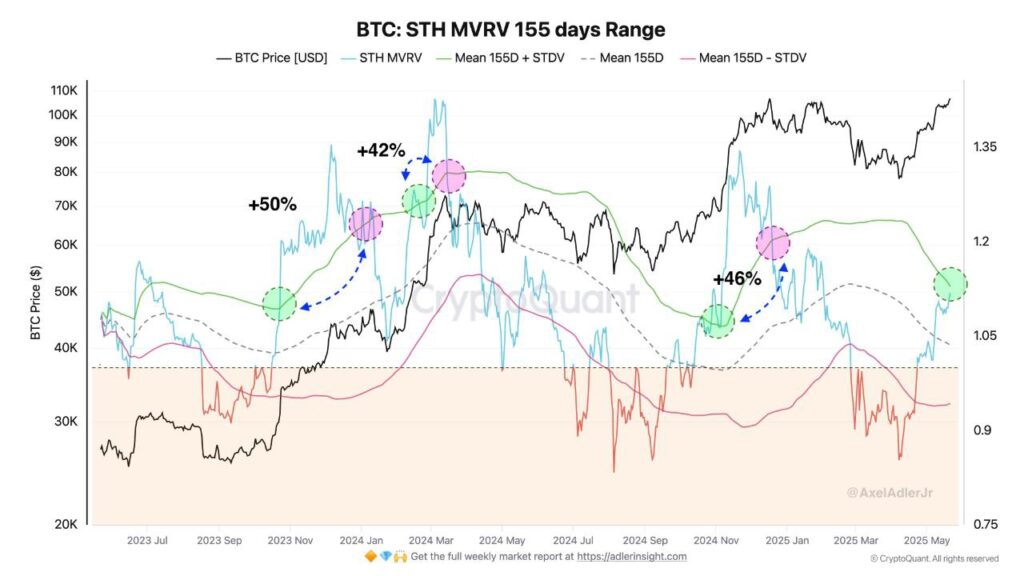

The latest chart on the MVRV for short-term holders (STH) reveals a critical insight for anyone tracking Bitcoin’s behavior. The market has not yet entered the high-risk zone typically associated with profit-taking.

But that could change soon.

What is the MVRV telling us?

The MVRV (Market Value to Realized Value) measures the average unrealized profit of holders. When applied to STH (short-term holders), the current MVRV has yet to cross the +1 standard deviation zone (marked by the green line). Historically, crossing that line has signaled the beginning of aggressive speculative rallies.

In previous cycles, once this level was breached, Bitcoin’s price climbed an additional 46% on average. In the current context, that would project a potential top near $154,000.

But there’s a catch.

ETF speculators may not wait that long

Unlike past cycles, the market now shows signs of reduced risk appetite, especially among institutional speculators operating through ETFs.

Many of these participants are expected to start selling around $126,000, particularly those who entered the market near $84,000. This selling pressure could kick in even before the MVRV reaches elevated levels.

What lies ahead?

Whether or not this rally continues depends on two key factors:

- Whether STHs hold their positions even with significant gains

- The behavior of ETF speculators, who might begin exiting early

If holders resist the urge to cash out too soon, Bitcoin could push toward or even beyond the +1 STDV mark. However, if funds begin selling aggressively, it could serve as a trigger for an earlier correction.

We’re at a point where technical indicators meet market psychology.

The data suggests room to climb, but risk sentiment and player behavior will set the pace.

Right now, it’s not just the chart dictating direction — it’s the hands holding or releasing the market.