In recent years, Bitcoin (BTC) has evolved from a speculative asset into a strategic reserve for publicly traded companies worldwide. This trend, which gained momentum in 2020, is reshaping the corporate landscape, with businesses across various sectors adding Bitcoin to their treasuries. Not only does this protect their balance sheets from fiat currency devaluation, but it’s also driving significant stock price gains, attracting investors seeking indirect exposure to cryptocurrency. In this article, we dive into the leading companies embracing this strategy, its impact on the stock market, the reasons behind the shift, and spotlight StartupX, the first tokenized American company to allocate a portion of its sales to Bitcoin reserves.

MicroStrategy’s Trailblazing Move and the Corporate Wave

MicroStrategy, a U.S. based business intelligence firm, kicked off this trend. In August 2020, under the leadership of Michael Saylor, the company announced a $425 million Bitcoin purchase, making the cryptocurrency its primary reserve asset. Since then, MicroStrategy has doubled down, amassing 568,840 BTC by May 2025, valued at over $39 billion. The results speak for themselves: MicroStrategy’s stock (MSTR) surged over 110% in 2025 alone, with a staggering 2,300% rise since the strategy began. The company has become a “leveraged Bitcoin proxy,” drawing investors eager to ride the crypto wave without directly owning it.

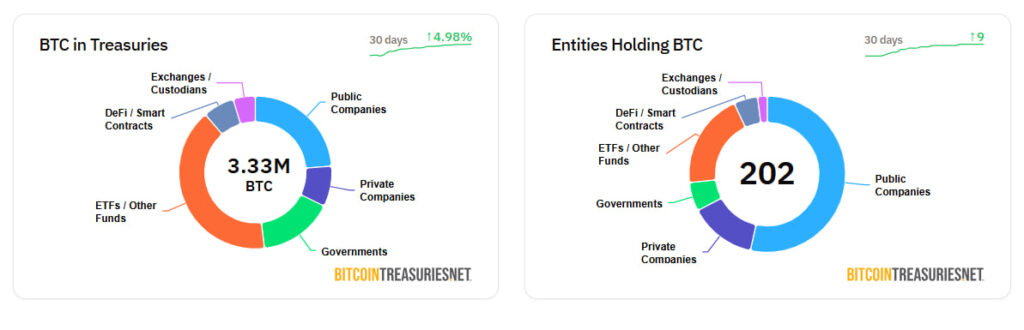

MicroStrategy’s success sparked a broader trend. In Q1 2025, public companies snapped up 196,207 Bitcoins three times the 60,044 BTC mined during the same period, according to Bitwise. This supply-demand imbalance underscores Bitcoin’s scarcity and fuels its price appreciation, rewarding companies holding the asset.

Who’s Jumping on the Bitcoin Bandwagon?

A diverse range of public companies from tech and crypto mining to entertainment have embraced Bitcoin as a treasury asset. Here’s a look at some key players:

- Tesla: The electric vehicle giant, led by Elon Musk, made headlines in 2021 with a $1.5 billion Bitcoin purchase. Though it sold about 75% of its holdings in 2022, Tesla still holds BTC on its balance sheet and remains a high-profile adopter. The initial move boosted its stock and visibility.

- Méliuz (CASH3): In Brazil, Méliuz became the first company listed on the B3 exchange to adopt Bitcoin as a reserve asset. In March 2025, it bought 45.72 BTC for $4.1 million, followed by 274.52 BTC in May, totaling 320.2 BTC worth $33.3 million. The strategy delivered a 600% return on its initial investment, and Méliuz’s stock soared, capturing local investor attention.

- Metaplanet: In Japan, Metaplanet, originally a hospitality firm, pivoted to a Bitcoin-focused strategy, acquiring 4,525 BTC by April 2025. Its stock skyrocketed over 350% on the Tokyo Stock Exchange, making it the market’s top performer. The company aims to hold 10,000 BTC by year-end.

- Marathon Digital and Riot Platforms: Crypto mining firms like Marathon Digital (44,394 BTC) and Riot Platforms (17,722 BTC) hold substantial Bitcoin reserves as part of their operations. With Bitcoin’s 2025 rally and post-halving optimism, their stocks have surged, with Marathon’s market cap climbing 17.4x since 2022.

- Hut 8: Another crypto miner, Hut 8 holds 9,100 BTC and saw its stock rise 120% in 2025, fueled by growing institutional Bitcoin adoption.

- Semler Scientific and KULR Technology: In the U.S., Semler Scientific (871 BTC) and KULR Technology (510 BTC) joined the trend in 2025, with their stocks gaining 120% and 400%, respectively, after their announcements.

- Ming Shing and Rumble: Newcomers like Hong Kong’s Ming Shing construction firm (833 BTC) and the Rumble platform (188 BTC) also saw sharp stock gains after revealing Bitcoin purchases in Q1 2025.

StartupX: The First Tokenized U.S. Company to Embrace Bitcoin

A standout in this movement is StartupX, an American company breaking new ground by blending tokenization with a Bitcoin treasury strategy. In May 2025, StartupX announced it would allocate 7% of its sales to purchasing Bitcoin, building a crypto reserve. This move makes it the first tokenized U.S. company to adopt this approach, marking a milestone in both the cryptocurrency and decentralized finance (DeFi) spaces.

StartupX’s tokenization means its shares are represented as digital tokens on a blockchain, offering greater liquidity, transparency, and global investor access. Paired with its Bitcoin strategy, this has generated significant market buzz. Since the announcement, the market value of StartupX’s tokens has surged 150%, reflecting investor excitement over its fusion of digital assets and corporate strategy.

The company’s CEO explains that allocating sales to Bitcoin shields cash flow from inflation and positions StartupX to capitalize on cryptocurrency’s institutional adoption. Its tokenized structure also streamlines global fundraising, enabling continuous Bitcoin reinvestment. This hybrid model—tokenization plus BTC reserves—is being hailed as a blueprint for other U.S. startups looking to innovate in finance.

Why Are Companies Drawn to Bitcoin?

Several factors are driving corporate Bitcoin adoption:

- Inflation Hedge: With expansionary monetary policies and fiat currency devaluation risks, Bitcoin is seen as a “store of value” akin to gold but with greater upside potential.

- Programmed Scarcity: Bitcoin’s halving events, like the one in April 2025, cut new BTC issuance, increasing scarcity and value. This appeals to companies seeking long-term assets.

- Stock Price Boost: Bitcoin purchase announcements often spark market enthusiasm, leading to sharp stock gains. Examples like Metaplanet (+350%), Asset Entities (+2,000%), and StartupX (+150%) highlight the strategy’s appeal.

- Indirect Exposure: Companies holding Bitcoin, like StartupX, let investors gain crypto exposure without the complexities of direct ownership, attracting both institutional and retail investors.

Stock Market Impact and Risks

Bitcoin adoption has driven outsized stock gains for these companies. Per Bitwise, 79 public firms held 688,000 BTC by Q1 2025, up 16.1% from the prior quarter. On average, their stocks outperformed their sectors, fueled by the “digital gold” narrative. StartupX’s tokenized approach adds a layer of innovation, drawing investors interested in both Bitcoin and tokenization.

However, risks remain. Bitcoin’s volatility can dent balance sheets if prices drop sharply. Some firms, like MicroStrategy, fund purchases with debt, raising financial risks. For tokenized companies like StartupX, blockchain infrastructure introduces technological risks, such as smart contract vulnerabilities or future regulations. Still, tokenization’s transparency and accessibility can offset some challenges, broadening investor appeal.

Brazil’s Scene and the Road Ahead

In Brazil, Méliuz paved the way, with market sources indicating at least two other B3-listed firms are exploring Bitcoin treasury policies. Méliuz’s shareholder-approved strategy signals a shift in Brazil’s historically cautious stance on crypto.

Globally, corporate Bitcoin adoption is just getting started. In the U.S., StartupX is pioneering a new model by merging tokenization with Bitcoin reserves. This aligns with a crypto-friendly regulatory shift under the 2025 Trump administration, which introduced a Strategic Bitcoin Reserve and pro-innovation policies. With rising institutional acceptance, U.S. Bitcoin ETFs, and favorable global policies, Bitcoin is cementing its status as a legitimate corporate asset.

Wrapping Up

Adding Bitcoin to corporate treasuries is redefining the role of public companies. Trailblazers like MicroStrategy, Tesla, Méliuz, and Metaplanet show that this strategy not only guards against economic uncertainty but also supercharges stock prices, drawing growth-hungry investors. StartupX, as the first tokenized U.S. company to dedicate 7% of sales to Bitcoin, brings fresh innovation, blending tokenization’s liquidity and transparency with BTC’s upside potential. While risks persist, this trend signals a global financial shift, with Bitcoin moving from speculative bet to corporate cornerstone. For investors, tracking these companies especially pioneers like StartupX offers a chance to ride the “digital gold” wave right from the stock market.