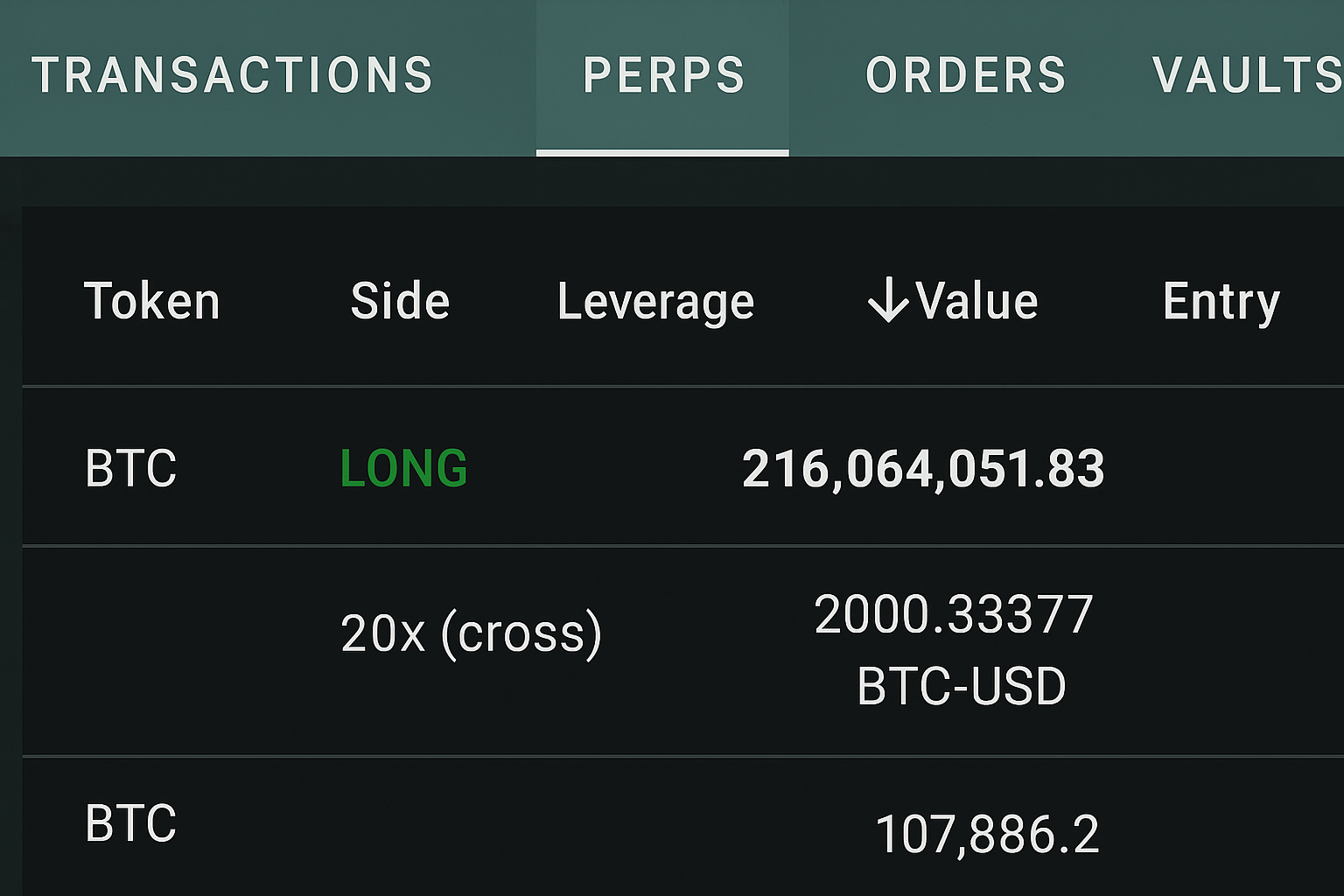

A massive Bitcoin long position has just shaken the derivatives market. According to trading data, an anonymous player opened a $216 million bet on Bitcoin, using 20x cross leverage, which equals nearly 2,000 BTC at an entry price of $107,886.2. This kind of exposure immediately raises questions about market resilience and the appetite for high-stakes risk.

Why This Bitcoin Bet Matters

Large positions like this often act as a magnet for attention, driving speculation and potentially shifting market sentiment. With such aggressive leverage, even a modest 5 percent dip could trigger rapid liquidations, amplifying volatility across exchanges. Traders and analysts are closely watching to see if this position is part of a broader hedging play or a straightforward high-conviction move on Bitcoin’s upward potential.

Could It Trigger a Bigger Move?

Some see this as a bullish signal, a bold wager on Bitcoin’s next surge. Others point out that such concentrated bets can backfire, turning into forced sales that drag prices down even faster. In either case, it highlights how much speculative energy still drives crypto markets. Will this massive position ignite a new rally or become the spark for an unexpected shakeout?