Institutional appetite soars while classic whales retreat. What’s next for BTC?

In the past twelve months, the Bitcoin ecosystem has experienced a profound redistribution of ownership that could reshape future volatility and price cycles. According to 10x Research combined with on-chain data from Glassnode, traditional large holders or so-called whales have offloaded over 500,000 BTC. This equals more than 50 billion dollars at current market valuations.

At the same time, ETFs, corporate treasuries and other institutional players have absorbed nearly 900,000 BTC, bringing their collective holdings to an estimated 4.8 million coins. That is close to 24 percent of Bitcoin’s circulating supply.

The numbers tell the story

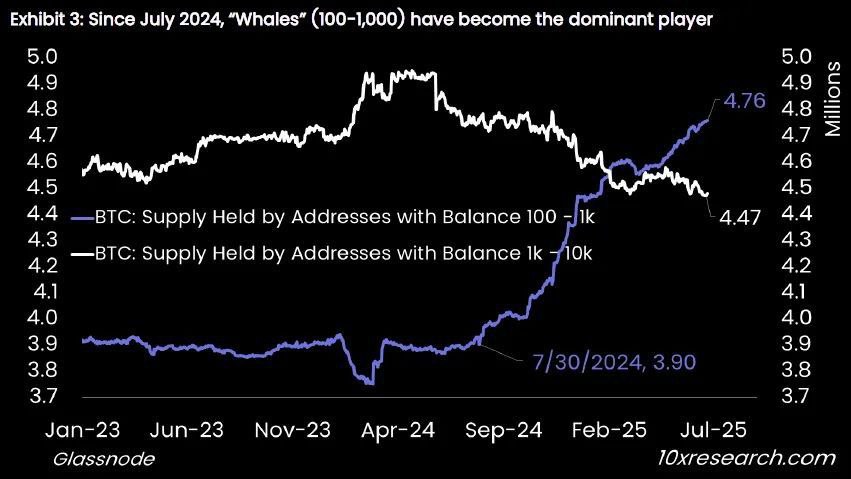

Glassnode data reveals two major trends. Wallets holding between 100 and 1,000 BTC have climbed to a record 4.76 million BTC by July 2025. These mid-sized whales are emerging as the dominant force, accumulating coins even as larger players step back.

Meanwhile, wallets with balances from 1,000 to 10,000 BTC have dropped to 4.47 million BTC, down from more than 4.9 million in early 2024. This points to a clear reduction by mega whales, possibly driven by profit-taking or strategic reallocation.

The broader market data backs this up. Spot Bitcoin ETFs in the United States alone have attracted over 16 billion dollars since January 2024, equivalent to around 400,000 BTC. When adding European, Canadian funds and direct corporate acquisitions, the absorption lines up closely with the 900,000 BTC shift highlighted by 10x Research.

Why does this matter

This new ownership landscape changes the game in several ways. With mega whales reducing exposure, market power is spreading across ETFs, funds and a wider base of mid-sized whales. ETFs also operate under different rules. They typically rebalance in a transparent way, which might reduce sudden shocks that used to come from private whale moves.

Meanwhile, companies adding Bitcoin to balance sheets signal a long-term conviction. These coins often end up in cold storage, taking them out of the short-term trading supply.

Where is Bitcoin heading

This trend points to Bitcoin evolving into a more institutionally anchored asset. Liquidity is shifting into vehicles with stronger governance and risk controls. That could calm some speculative excesses but also pull in larger pools of capital that want a hedge against fiat depreciation.

With roughly 24 percent of all BTC now effectively locked in ETFs and corporate treasuries, future bull markets could face sharper supply crunches. This scenario might drive more intense price movements when retail enthusiasm and new institutional demand return.

The next big direction for Bitcoin will likely depend on macro factors such as interest rates, global liquidity and whether regulators continue approving more crypto investment products. The current data shows a market growing under the weight of institutional buying, yet still primed for major moves once the broader sentiment shifts back to risk appetite.