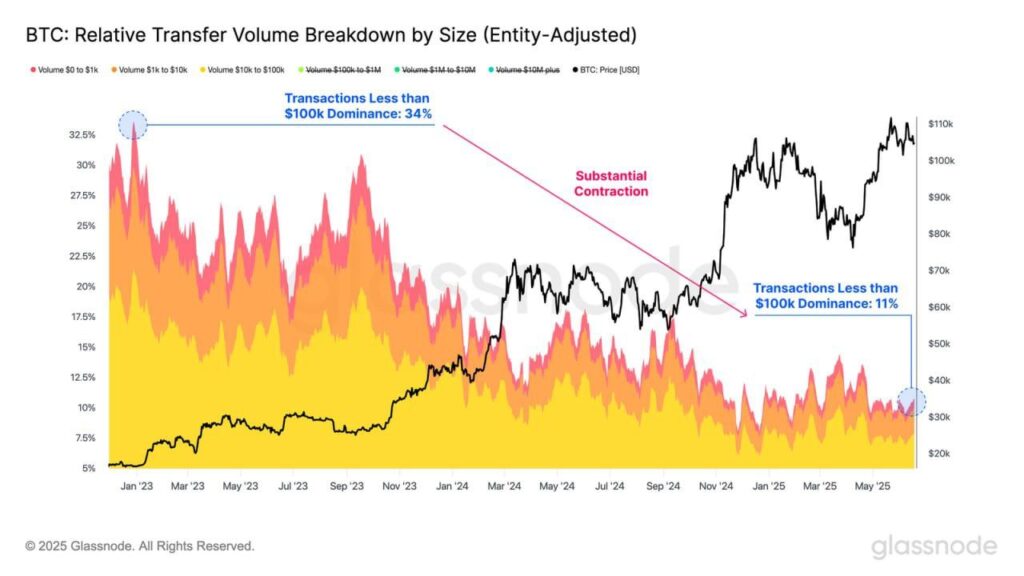

Bitcoin’s network is seeing a dramatic reshaping of activity. The share of smaller transactions once the backbone of on-chain flows has plunged, giving way to overwhelming dominance by whales and institutional-sized transfers.

Retail flows see historic contraction

According to the latest data from Glassnode and complementary on-chain analytics, transactions under $100,000 have collapsed from representing 34% of total BTC volume in late 2022 to just 11% today.

This drop is consistent across all key segments:

- $0–1k: fell from 3.9% to 0.9%

- $1k–10k: from 8.4% to 2.1%

- $10k–100k: from 21.4% to 7.9%

Such a broad retreat underscores how retail and smaller investors are no longer major drivers of direct on-chain settlement.

Whales and institutions now control 89% of transfer volume

At the same time, transactions over $100k have grown to dominate roughly 89% of all BTC transfer volume, up from 66% in 2022. This is also reflected in other metrics:

- The average on-chain transaction size is now over $36,200.

- Daily BTC settled value oscillates between $7.5 billion to $16 billion, highlighting large movements likely tied to funds, treasuries and ETF custodians.

Why the shift matters

This trend signals a profound evolution in Bitcoin’s market structure:

- Retail investors increasingly use custodial platforms, off-chain solutions or layer 2s, reducing their footprint on the base chain.

- Institutional players and large holders (whales) dominate capital flows, concentrating liquidity and influencing price dynamics more directly.

- For regulators and market analysts, it’s a sign that Bitcoin’s systemic impact is growing but also more sensitive to big players’ actions.

What to watch next

As Bitcoin continues its climb above $100,000, the question isn’t just about price anymore. It’s about who moves the money, and how the balance between small holders and whales shapes liquidity, volatility and long-term decentralization.